Assessment & Taxation

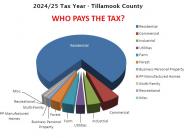

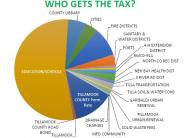

The Assessment and Taxation Department is responsible for the assessment of all Real and Personal property within Tillamook County, as well as the collection of the corresponding property taxes. The results of our efforts generate revenue for the taxing districts, enabling them to fund public safety, public health, public education, and various other services that enhance the quality of life for the citizens of Tillamook County.

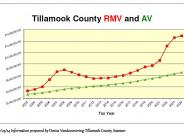

We maintain records on approximately 30,000 property tax accounts with a real market value of over $12.9 billion and over $6.5 billion of assessed value. We are a broad service organization mandated by the Oregon Constitution and Oregon law.

Pay property taxes, view property tax statements, search property records.

Current Bonds and Local Options